WTI Price Analysis: Bears eye further downside towards $108.00 ahead of OPEC meeting

- WTI remains on the back foot around one-week low, prints three-day downtrend.

- Chatters surrounding Russia leaving OPEC+, Saudi output increase favor bears.

- Clear downside break of monthly support and sustained trading below 50-SMA also keep sellers hopeful.

WTI bears keep reins around the weekly low during the third consecutive negative day, down 1.45% to $111.90 during Thursday’s Asian session.

The black gold’s latest weakness could be linked to speculations that Russia may leave the OPEC+ group, as well as talks of Saudi Arabia’s likely increase of oil output.

Read: Saudi Arabia ready to pump more oil if Russian output sinks under ban – FT

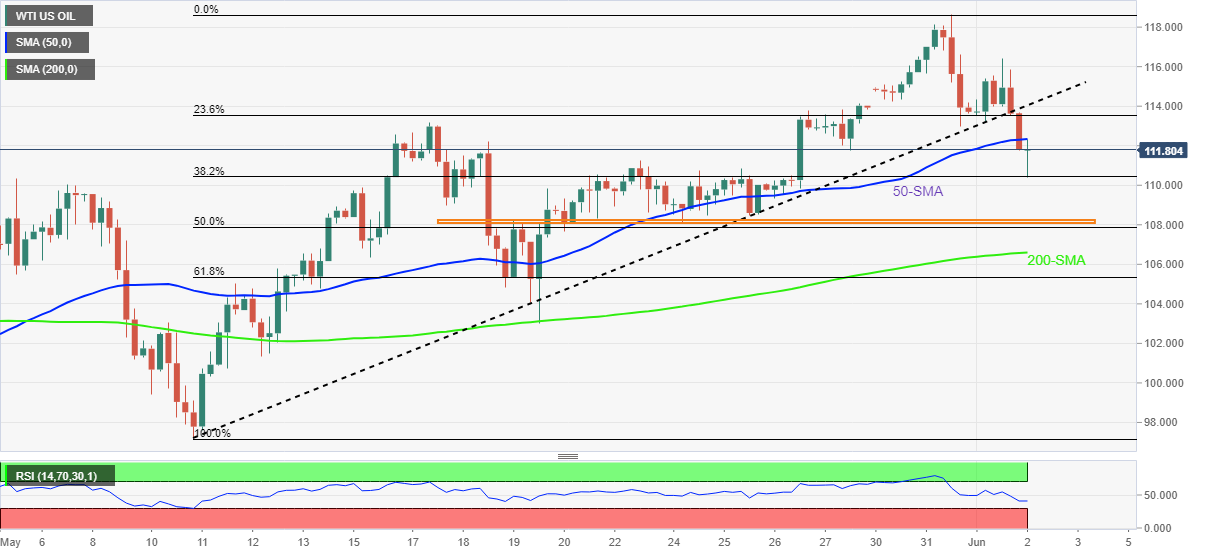

Also keeping sellers hopeful is the previous day’s downside break of an ascending support line from early May, now resistance surrounding $114.10.

Additionally, the quote’s sustained trading below 50-SMA, at $112.35 by the press time, also hints at the further downside.

That said, a horizontal area comprising multiple levels marked since May 19, near $108.00, gains the WTI bear’s attention.

However, a clear break of the 38.2% Fibonacci retracement of the May 10-31 upside, at $110.40, becomes necessary for the bears.

During the quote’s weakness past $108.00, the 200-SMA level of $106.60 will gain the market’s attention.

Meanwhile, the 50-SMA and previous support line, respectively around $112.35 and $114.10, can restrict the quote’s corrective pullback.

In a case where WTI remains firmer past $114.10, an upward trajectory towards $116.50 and the last monthly peak near $118.70 can’t be ruled out.

WTI: Four-hour chart

Trend: Further weakness expected