EUR/USD: In bullish consolidation above 1.1800, overbought RSI warrants caution

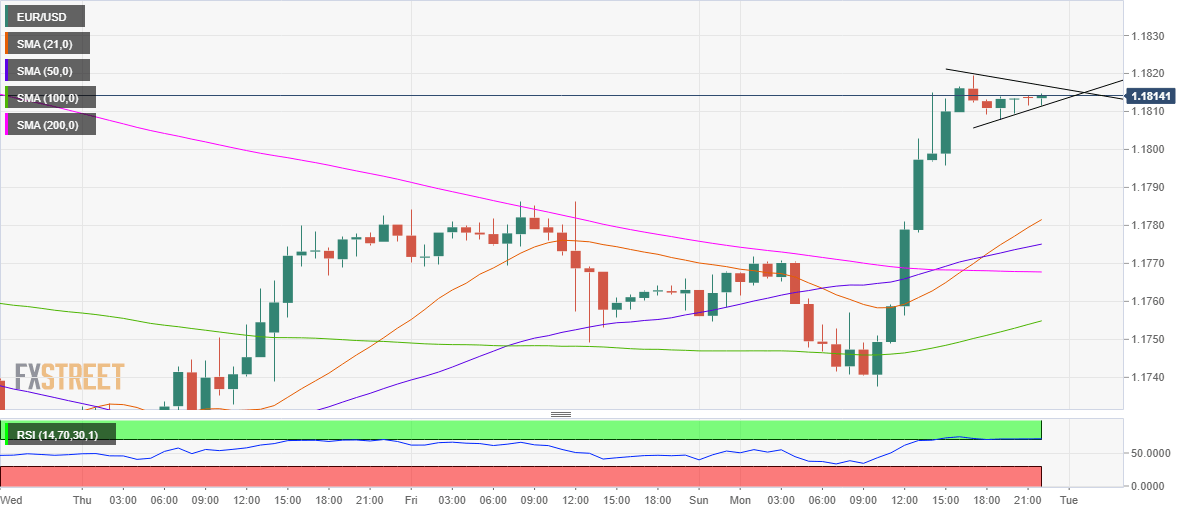

- EUR/USD is on the verge of a bull pennant breakout on the 1H chart.

- RSI trends in overbought region, warrants caution for the EUR bulls.

- Eurozone Sentix and Unemployment rate in focus amid tepid mood.

EUR/USD is consolidating near weekly highs of 1.1820, as the US dollar holds the lower ground across the board after Monday’s sharp sell-off.

The main currency pair rallied hard a day before, benefiting from the improved market mood, which downed the safe-haven US dollar.

Further, the greenback was undermined by the fall in the US Treasury yields amid uncertainty over the passage of President Joe Biden’s $2.25 trillion infrastructure plan.

Markets ignored the dour covid situation in Europe, as the cases continue to rise and vaccination rate remain unimpressive. All eyes now remain on the Eurozone Sentix Investor Confidence and Unemployment Rate for fresh cues after the US ISM Services PMI bettered expectations.

EUR/USD: Technical outlook

As observed on the hourly chart, the major has carved out a potential bull pennant formation after Monday’s sharp rise that followed a consolidation.

Therefore, an hourly close above the falling trendline resistance at 1.1817 could validate the bullish continuation pattern, opening doors for a test of the measured target at 1.1886.

Ahead of that level, the psychological 1.1850 barrier could challenge the bullish commitments.

However, the relative strength index (RSI)

EUR/USD: Hourly chart

However, with the relative strength index (RSI) lying in the overbought territory, it calls for a cause for concern for the EUR bulls.

Hence, a corrective pullback towards the bullish 21-hourly moving average (HMA) cannot be ruled out before the uptrend resumes.

The bullish crossovers spotted on the said time frame continue to keep the buyers hopeful.

EUR/USD: Additional levels