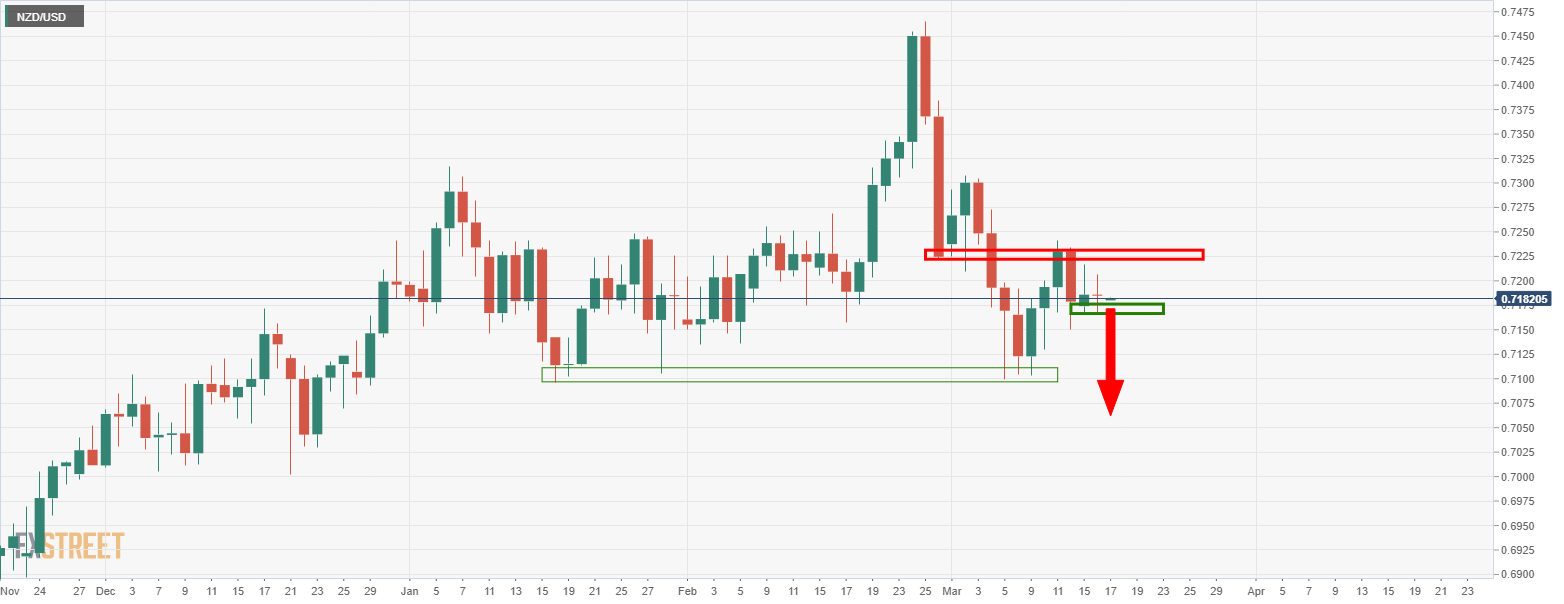

NZD/USD Price Analysis: Daily downside extension on the cards in a break of support

- NZD/USD bears creeping back up to the table, pressing on daily support.

- Bears can look for a 4-hour entry on a break of daily support.

As per this week's, The Watchlist: NZD/USD and EUR/JPY in focus for the open, and the following prior analysis subsequent of the initial outlook, the price is starting to drawing in the bear's attention once again from a daily perspective.

Prior analysis

...a bearish bias was illustrated from the weekly and daily charts as follows:

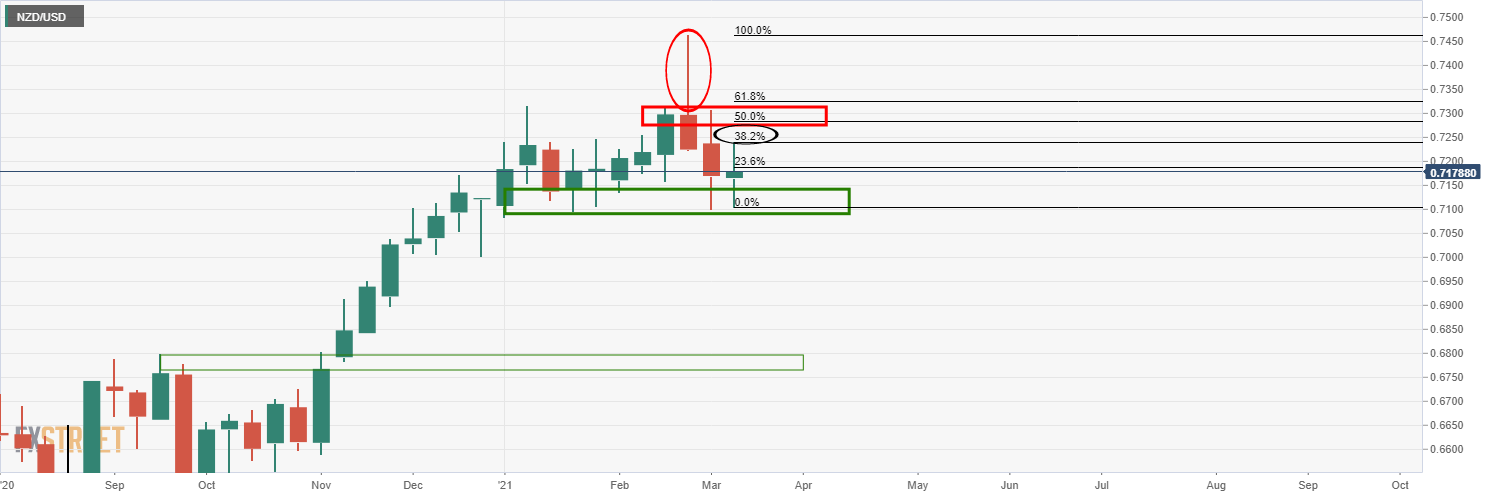

NZD/USD weekly chart

The weekly chart is bearish according to the strong rejection candle.

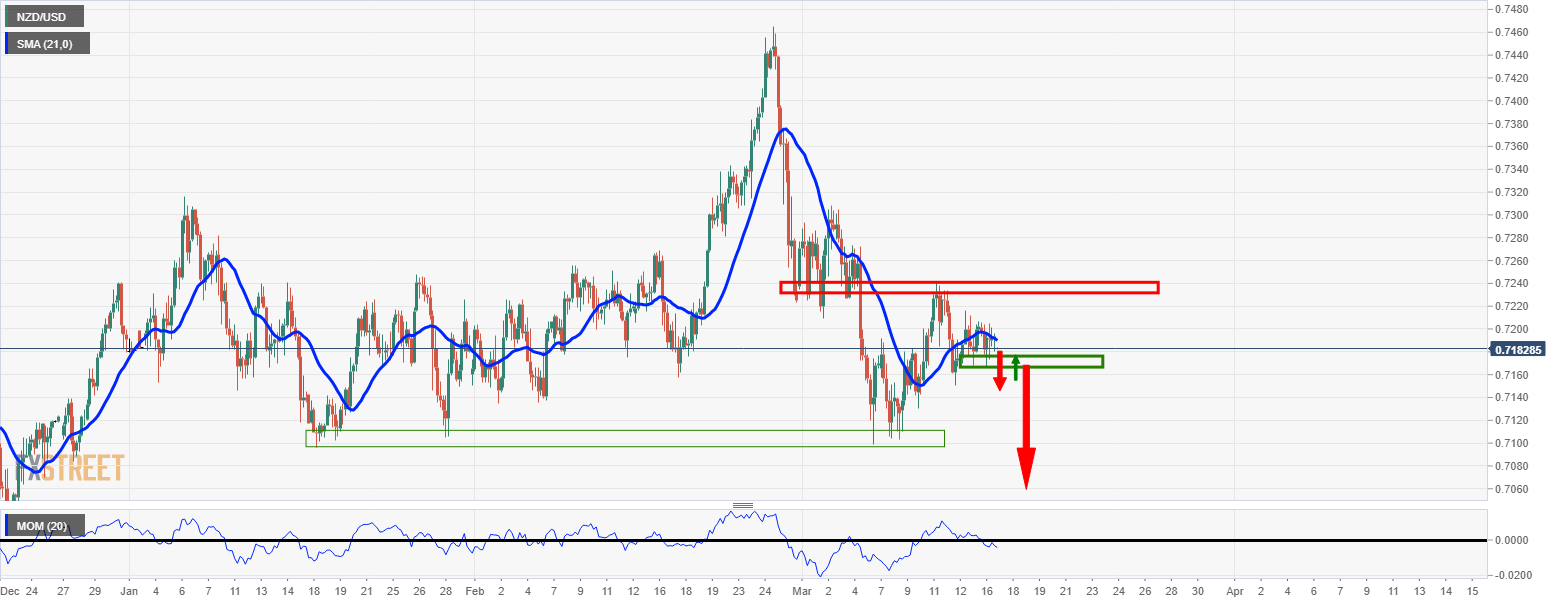

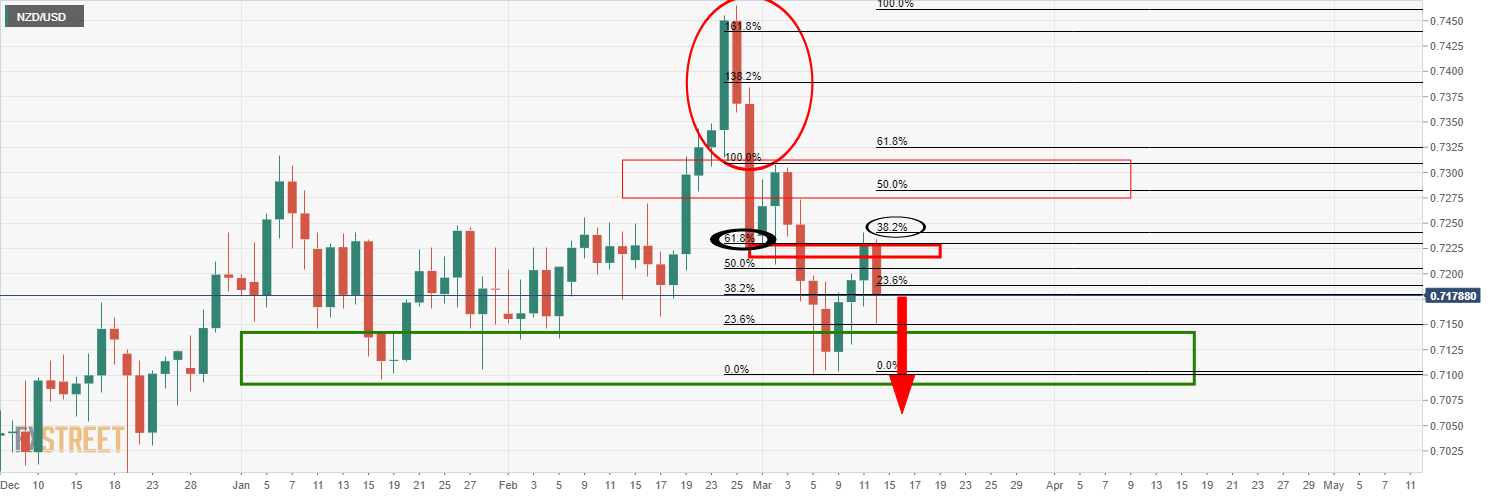

Prior analysis, daily chart

The daily bearish engulfing has led to the pair dropping and correcting to a 38.2% Fibonacci retracement level which is significant enough to ow expect a downside continuation to test deeper into the demand zone.

Traders will be on the lookout for bearish conditions on the 4-hour time frame for a swing trading opportunity.

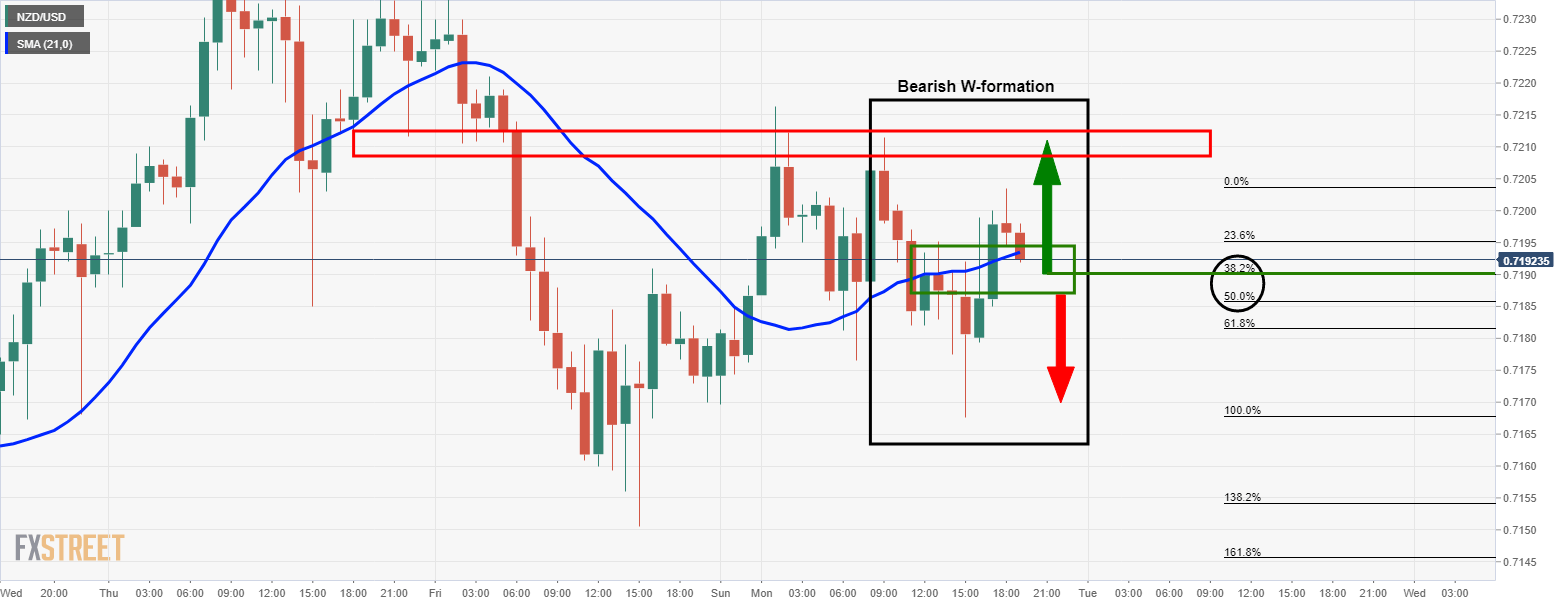

Prior analysis,1-hour chart

From an hour perspective, bears will want to see the price break below the 50% mean reversion area within the bearish W-formation.

In doing so, the bias will be firmly with the bears once again, reverting back to the daily chart's bearish bias.

Live market

The price is starting to move through the daily support, but there is still far too much of a risk of an upside move from the demand area.

That being said, if the support breaks, then bears can seek a restest of the structure from the lower time frames, such as the 4-hour chart, for an optimal entry point with a sell limit order to target a downside extension.