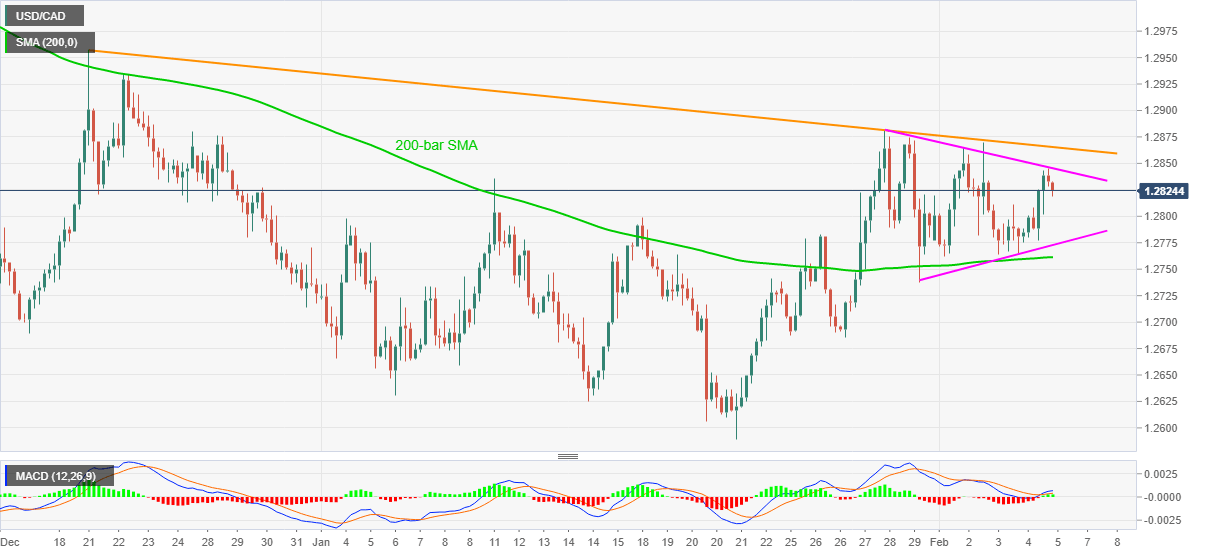

USD/CAD Price Analysis: Prints bullish pennant on 4H

- USD/CAD eases above 1.2800, consolidates the previous day’s gains inside bullish chart pattern.

- Seven-week-old resistance line adds to the upside filter.

- Sustained trading beyond 200-bar SMA joins pennant to keep buyers hopeful.

USD/CAD bulls catch a breather after Thursday’s upbeat performance as the quote eases from 1.2845 to currently 1.2825 amid the early Asian session on Friday. Even so, the pair remains inside a bullish chart pattern, pennant, on the four-hour (4H) formation.

As a result, the latest pullback in the USD/CAD isn’t worrisome unless breaking the pennant’s support line, at 1.2770 now. Also challenging the bears’ entry is 200-bar SMA level of 1.2761.

It should be noted that the bullish MACD counters the pair’s sustained trading below a downward sloping trend line since December 21, currently around 1.2865. This gives an extra hurdle to the north, in addition to the pennant resistance of 1.2850.

Hence, USD/CAD bulls should be careful in case of the downside break of 1.2760 while the bears may not take interest in the pair on breaking 1.2865.

In a case where USD/CAD rises past-1.2865, late December’s top near 1.2955-60 can offer as an intermediate stop during the rally towards the 1.3000 trheshold.

On the contrary, a downside break below 1.2760 may eye for the yearly bottom surrounding 1.2590.

USD/CAD four-hour chart

Trend: Further upside expected