USD/CAD Price Analysis: Bears attack three-week-old horizontal support above 1.2800

- USD/CAD remains on the back foot while refreshing the intraday low.

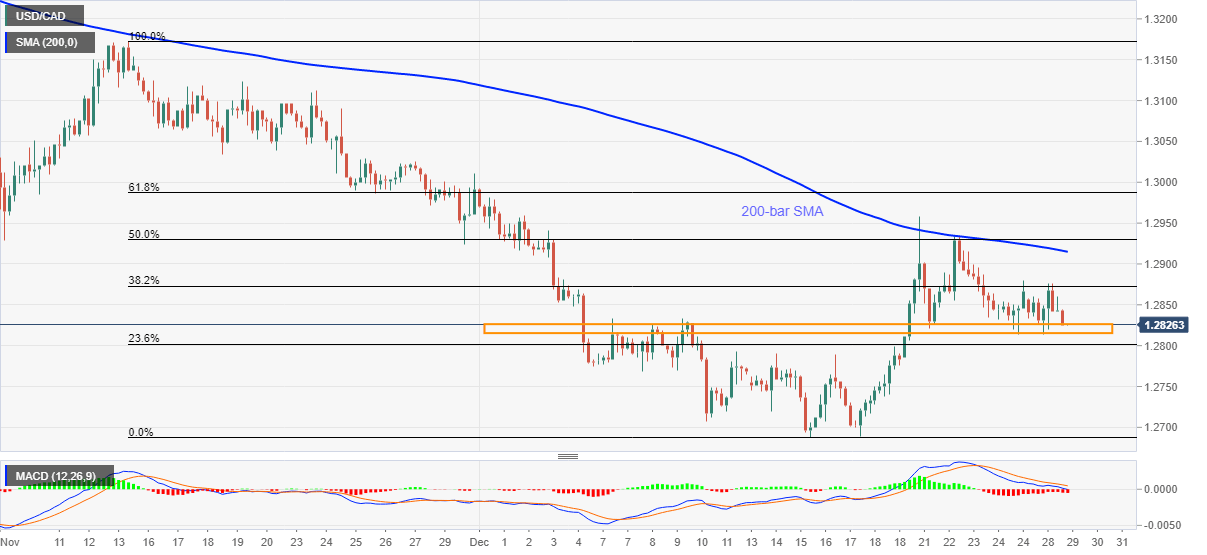

- Bearish MACD, sustained trading below 200-bar SMA favor sellers.

- Key Fibonacci retracements add to the upside barriers.

USD/CAD drops to 1.2826, down 0.14% on a day, during the early Tuesday. In doing so, the loonie pair battles a horizontal area comprising multiple levels marked since December 07.

Although the key support restricts short-term USD/CAD declines around 1.2825/15, the pair’s failures to cross 200-bar SMA and bearish MACD signals indicate further weakness towards challenging the 1.2800 threshold.

Should the quote remains downbeat past-1.2800, 1.2770 can offer an intermediate halt during the south run to refresh monthly low under 1.2688.

Meanwhile, 1.2880 guards the immediate upside of USD/CAD prices ahead of highlighting the 200-bar SMA resistance of 1.2916.

Even if the USD/CAD buyers manage to cross 1.2916, 50% and 61.8% Fibonacci retracement of November 13 to December 15 downside, respectively around 1.2930 and 1.2985, will precede the 1.3000 psychological magnet to test any further rise.

USD/CAD four-hour chart

Trend: Bearish