Gold Price News and Forecast: XAU/USD price might be dropping from the megaphone top

Gold: 1970 is the better selling opportunity this week

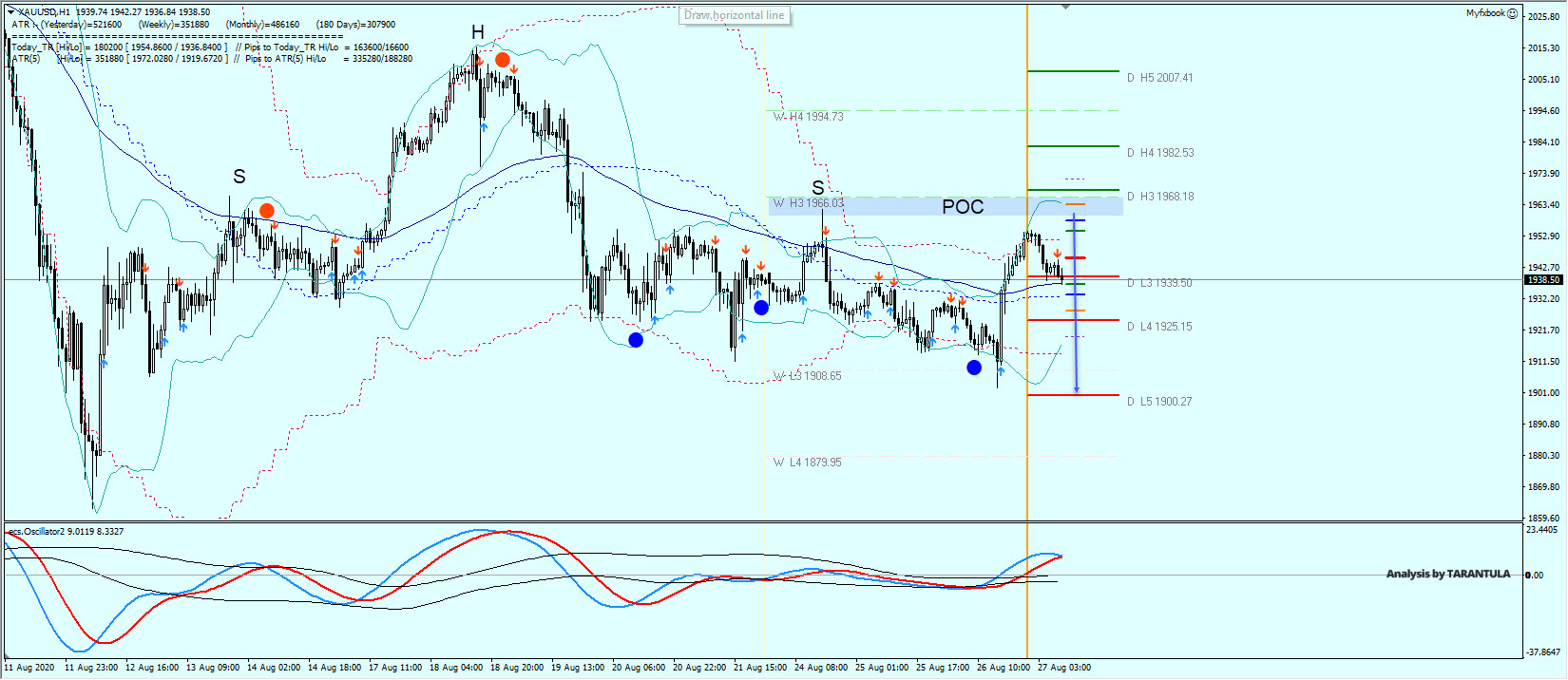

Gold Spot in a volatile sideways consolidation exactly as predicted many days ago, making holding longs risky at this stage despite the longer term bull trend. There are risks of a further correction to the downside.

Initially we held below 1925/20 for a sell signal targeting 1902/00 & bottomed exactly here. An unexpectedly strong recovery shot higher through 1930 to the next target & resistance at 1951/53. We topped exactly here. Outlook remains erratic & volatile. Read More...

Gold price might be dropping from the megaphone top

Gold is currently in an intraweek downtrend. We still might expect selling the rallies and bearish continuation moves.

On the H1 chart, we can spot huge bearish Head and Shoulders pattern which is looming above the price. 1966-70 zone is the POC where sellers should appear. If we don't see a retracement towards the POC zone, watch for a continuation below D L4 camarilla – 1925. Targets are 1919 followed by 1908 and 1900. Only a move above 1982 will temporary negate the bearish scenario. Read More...

Gold Price Analysis: XAU/USD trades with modest losses, around $1945-40 region

Gold maintained its offered tone through the early European session and was last seen hovering near the lower end of its daily trading range, around the $1940 region.

The precious metal failed to capitalize on the previous day's goodish rebound from the $1900 neighbourhood, or two-week lows and met with some fresh supply on Thursday. The downtick lacked any obvious fundamental catalyst and could be solely attributed to some technical selling from the $1955 supply zone. Read More...