US Dollar Index loses the grip further and drops to 94.80

- DXY intensifies the decline to new lows near 94.80 on Wednesday.

- The YTD low emerges as the next target at 94.65 (March 9).

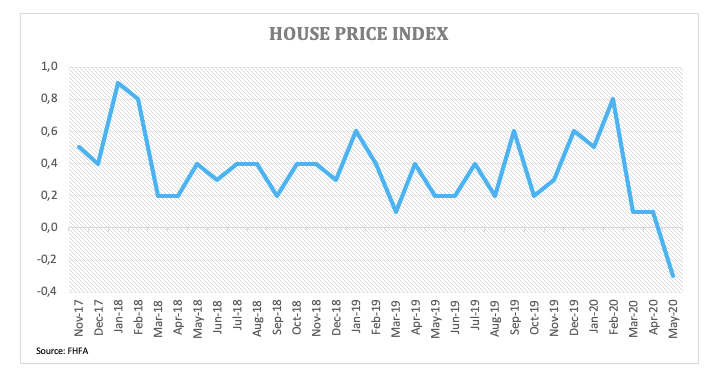

- FHFA’s House Price Index contracted 0.3% MoM in May.

Another day, another fresh low in the greenback. This time the US Dollar Index (DXY) has broken below the 95.00 support and it has recorded new 4-month lows around 94.80.

US Dollar Index debilitated by risk-on sentiment

The index has extended the decline to levels last seen in March in the sub-95.00 region, always in response to the unabated strength surrounding the riskier assets.

This risk-favourable atmosphere has been supported further after European leaders clinched a deal earlier in the week securing €750 billion in funds aimed at helping economies in that region to counteract the devastating impact of the coronavirus pandemic.

In addition, news regarding the development of a potential COVID-19 vaccine has been also collaborating with the upbeat mood among market participants.

In the docket, the House Price Index tracked by the FHFA contracted at a monthly 0.3% during May. Later in the session, June’s Existing Home Sales are due seconded by the weekly report on crude oil inventories by the EIA.

What to look for around USD

The relentless advance of the pandemic in the US and across the world vs. the probability that a COVID-19 vaccine could be out in the medium-term plus the ongoing reopening of global economies are all driving the sentiment in the global markets and keep the dollar under downside pressure. On the constructive view of the dollar, bouts of risk aversion should support the investors’ preference for the greenback as a safe haven along with its status of global reserve currency and store of value. On another front, the speculative community kept adding to the offered note around the dollar for yet another week, opening the door to a potential development of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is losing 0.21% at 94.95 and faces the next support at 94.83 (monthly low Jul.22) seconded by 94.65 (2020 low Mar.9) and then 94.20 (38.2% Fibo of the 2017-2018 drop). On the other hand, a break above 96.03 (50% Fibo of the 2017-2018 drop) would aim for 97.64 (55-day SMA) and finally 97.80 (weekly high Jun.30).