US Dollar Index trades around 4-month lows near 95.60

- DXY recorded new multi-month lows near 95.60 during early trade.

- Risk-on mood continues to dictate the sentiment in the global markets.

- Chicago Fed Index, API weekly report only of note in the US docket.

The US Dollar Index (DXY), which tracks the buck vs. a bundle of its main competitors, remains on the defensive well below the 96.00 mark on turnaround Tuesday.

US Dollar Index focused on risk trends, pandemic

The index is struggling for direction on Tuesday although stays well immersed into the broader bearish range, accelerated after the recent breakdown of the key support at 96.00 the figure.

The risk appetite trends have been boosted in past hours in response to auspicious news from the development of a coronavirus vaccine (this time from the Oxford-AstraZeneca front), coupled at the same time with solid hopes of a strong recovery in the economy.

Later in the US calendar, the Chicago Fed National Activity Index and the weekly report on the US crude oil stockpiles by the American Petroleum Institute (API) will be the only releases of note on Tuesday.

What to look for around USD

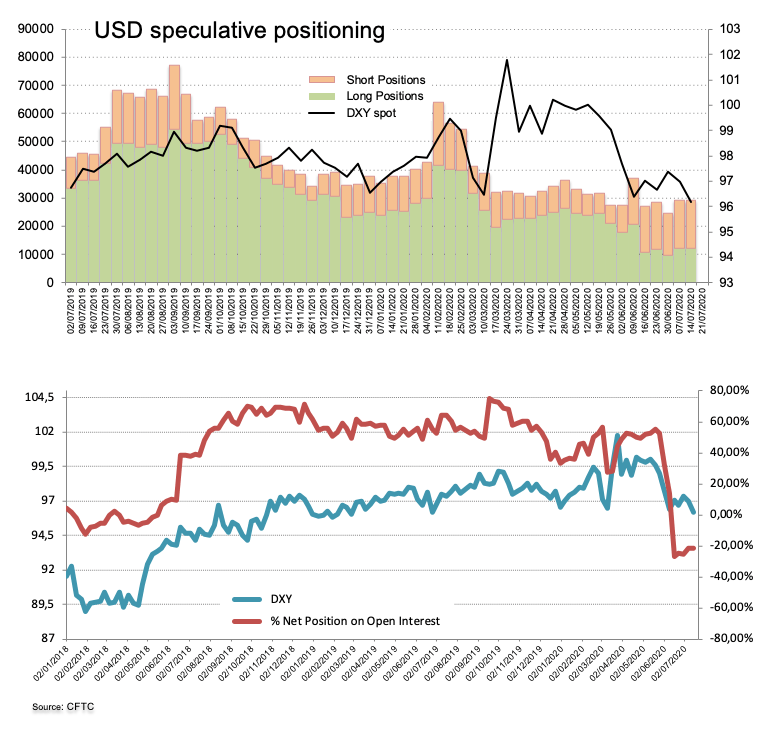

The relentless advance of the COVID-19 pandemic in the US and across the world vs. news of a potential vaccine that could be developed before markets’ expectations plus the ongoing reopening of global economies are all driving the sentiment in the global markets and keep the dollar under pressure. On the constructive view of the dollar, bouts of risk aversion should support the investors’ preference for the greenback as a safe haven along with its status of global reserve currency and store of value. On another front, the speculative community kept adding to the offered note around the dollar for yet another week, opening the door to a potential development of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is losing 0.02% at 95.79 and faces the next support at 95.63 (monthly low Jul.21) seconded by 94.65 (2020 low Mar.9) and then 94.20 (38.2% Fibo of the 2017-2018 drop). On the other hand, a break above 97.80 (weekly high Jun.30) would aim for 97.87 (61.8% Fibo of the 2017-2018 drop) and finally 98.17 (200-day SMA).