AUD/JPY Price Analysis: Fizzles upside momentum below five-week-old resistance

- AUD/JPY extends pullback from 75.15 in risk-off markets.

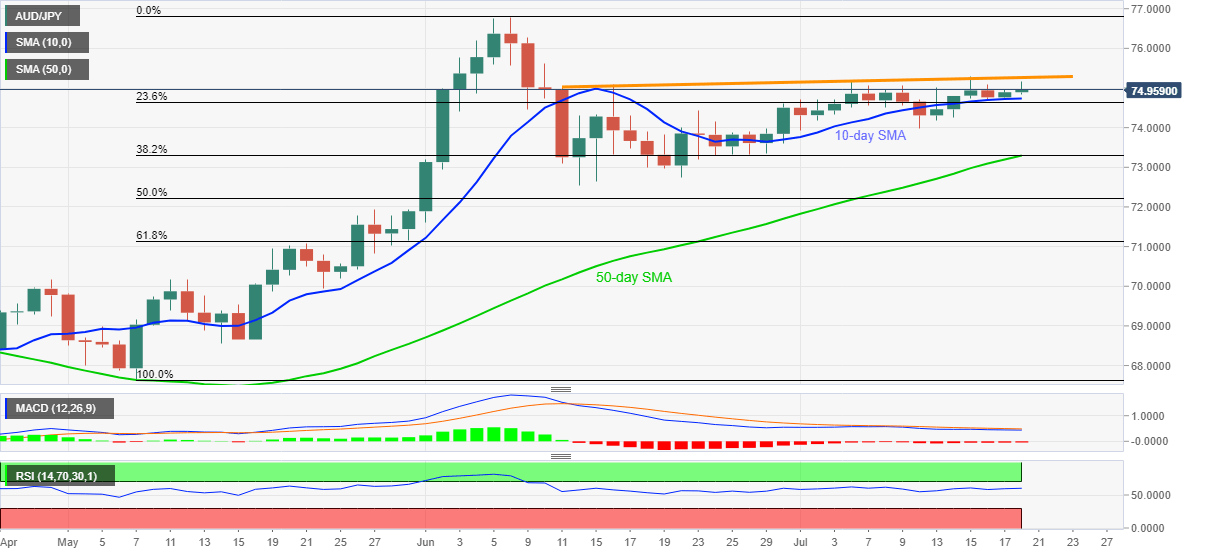

- 10-day SMA offers immediate support, 50-day SMA, 38.2% Fibonacci retracement become the key level.

- An upside break of resistance line can easily challenge June month’s top.

- Bearish MACD, multiple failures to cross crucial upside barriers suggest bears rolling their sleeves for entry.

AUD/JPY trims the early-day gains while declining to 74.94 during the early trading session on Monday. While the recent risk aversion wave dragged the quote again backward from an upward slopping trend line from June 10, bearish MACD suggests sellers are preparing for entry.

However, a 10-day SMA level of 74.73 can restrict the pair’s immediate downside ahead of the monthly low near 73.90.

During the pair’s further weakness past-73.90, a confluence of 50-day SMA and 38.2% Fibonacci retracement of May-June upside, around 73.30, will be the crucial support as it holds the gate for the bears’ reign to 72.60.

Alternatively, an upside break beyond the 75.30 resistance line will quickly propel the quote towards June month’s top near 76.80. Though, 76.00 might offer an intermediate halt during the rise.

Should the pair rise successfully past-76.80, May 07, 2019 top near 78.05 could lure the optimists.

AUD/JPY daily chart

Trend: Pullback expected