Gold Price Analysis: XAU/USD buyers aim to cross $1,800

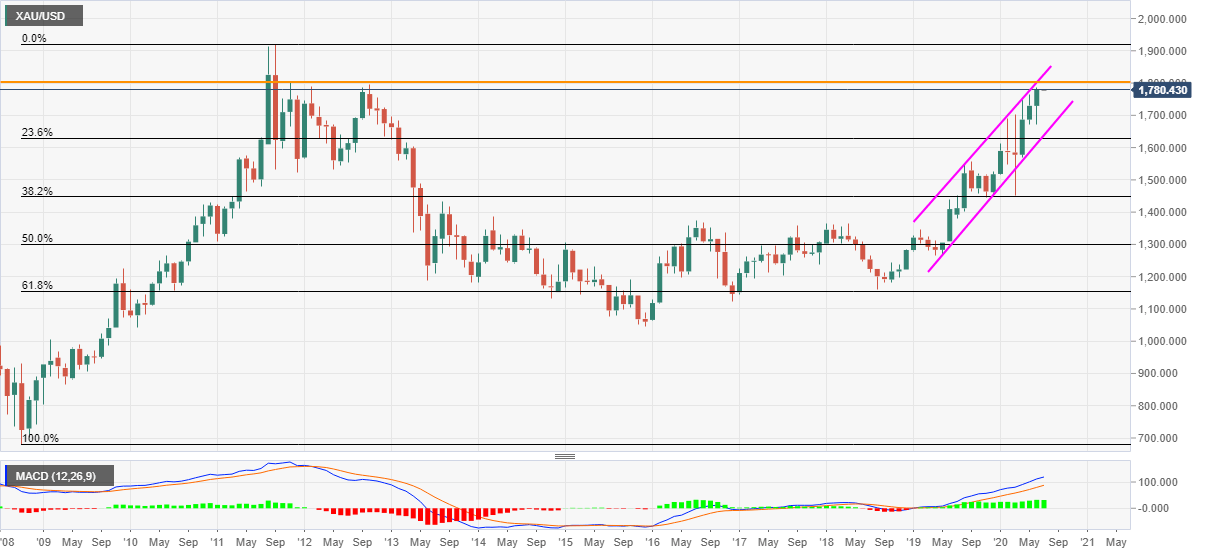

- Gold prices consolidate gains following the run-up to refresh late-2012 high.

- Ascending trend channel, bullish MACD on the monthly chart signal further upside.

- The sellers could wait for entries below the February month top.

Gold prices retrace from fresh high since October 2012 to around $1,780 amid the early Wednesday morning in Asia. The bullion previously surged to $1,785.91 while staying inside an upward sloping trend channel stretched from May 2019. Also favoring the precious metal’s upside were bullish signals by the MACD.

As a result, the traders might continue their efforts to conquer the year 2012 tope near $1,795/96. Additionally, the $1,800 threshold and November 2011 peak surrounding $1,803 could lure the optimists afterward.

Although the said channel’s resistance line, at $1,828 now, might confine the quote’s further upside, any more rise beyond that might not hesitate to challenge September 2011 top close to $1,921/22.

Alternatively, February month high near $1,690 offers strong downside support to the yellow metal prices. Before that, $1,750 and $1,700 might entertain the short-term bears.

During the safe-haven’s further fall below $1,690, the channel’s support line, currently around $1,638, becomes the key to watch.

Gold monthly chart

Trend: Bullish