Back

25 Mar 2020

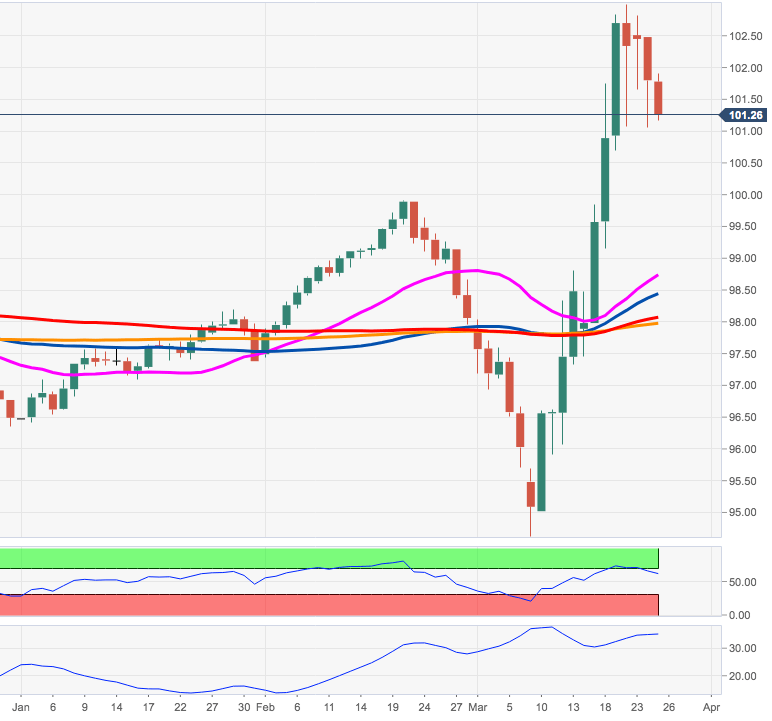

US Dollar Index Price Analysis: Retracement seen testing 100.00

- DXY continues to correct lower after failing around 103.00.

- The continuation of the downside could extend to the 100.00 mark.

DXY remains on the defensive following another rejection from the area of yearly peaks in the boundaries of 103.00 the figure.

If the selling mood picks up pace, the index carries the potential to slip pack to, initially, the Fibo retracement (of the 2017-2018 drop) at 100.49 ahead of the psychological triple-mark support.

Looking at the broader picture, the positive outlook in the buck remains unchanged as long as the 200-day SMA (97.96) holds the downside.

DXY daily chart