EUR/USD met support near 1.0860, US CPI in sight

- EUR/USD gains some poised and bounces off YTD lows.

- German final January CPI matched preliminary readings.

- US January CPI, Initial Claims coming up next in the docket.

The single currency has managed to regain some attraction and is lifting EUR/USD to the vicinity of 1.0860 in the second half of the week.

EUR/USD weaker on EMU results, USD-buying

The sharp sell-off in the pair looks to have met some decent contention in the proximity of 1.0860, fresh yearly lows and levels last traded in April 2017.

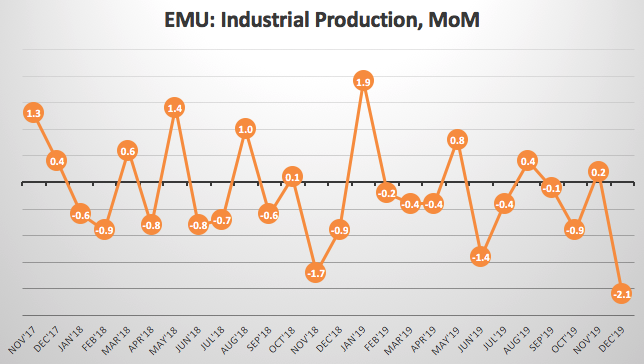

The downside in the spot has intensified following miserable prints from the Industrial Production in the euro area (published on Wednesday), which not only remains well entrenched into the contraction territory, but it also put to rest speculations regarding potential “green dots” in the bloc.

Additionally, the rally in the greenback appears solid and well in place for the time being, in a context where the risk-on mood continues to prevail favoured by ebbing concerns around the Chinese COVID-19.

Earlier in the session, German final inflation figures for the month of January came in in line with the preliminary readings. Across the pond and later in the NA session, January’s inflation figures tracked by the CPI will be the salient event seconded in relevance by usual weekly Claims and the speech by New York Fed J.Williams.

What to look for around EUR

The pair is managing to bounce of YTD lows near 1.0860 region (Wednesday) on the back of an apparent correction lower in the greenback. In the meantime, USD-dynamics are expected to dictate the pair’s price action for the time being along with the broad risk trends, where the COVID-19 is still in the centre of the debate. On another front, the ECB is expected to finish its “strategic review” (announced at its January meeting) by year-end, leaving speculations of any change in the monetary policy before that time pretty flat. Further out, latest results from the German and EMU dockets continue to support the view that any attempt of recovery in the region remains elusive for the time being and is expected to keep weighing on the currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.12% at 1.0885 and faces the next resistance at 1.0957 (weekly high Feb.10) seconded by 1.1017 (21-day SMA) and finally 1.1076 (55-day SMA). On the other hand, a break below 1.0865 (weekly/2020 low Feb.13) would target 1.0814 (78.6% Fibo of the 2017-2018 rally) en route to 1.0569 (monthly low Apr.10 2017).