Back

30 Jan 2020

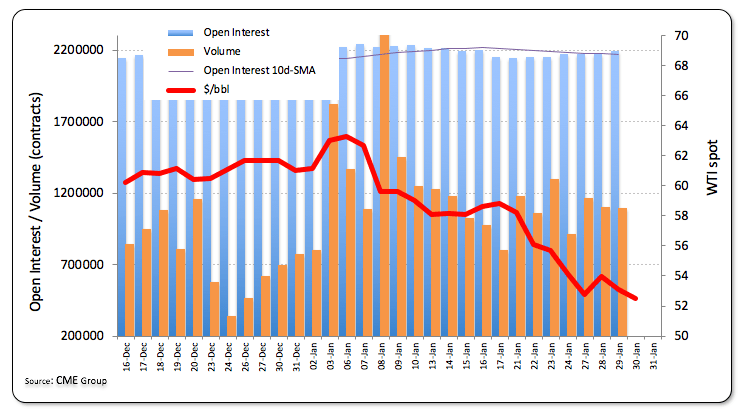

Crude Oil Futures: Look neutral/bearish near-term

Traders added nearly 24K contracts to their open interest positions on Wednesday, reversing the previous drop according to advanced data from CME Group. On the other hand, volume shrunk for the second session in a row, now by around 13K contracts.

WTI does not rule out a breach of $52.00

Crude oil prices remain well on the defensive this week. Wednesday’s resumption of the downtrend in WTI was accompanied by rising open interest, allowing for the continuation of the offered bias for the time being. The inconclusive performance in volume is seen adding to this view.