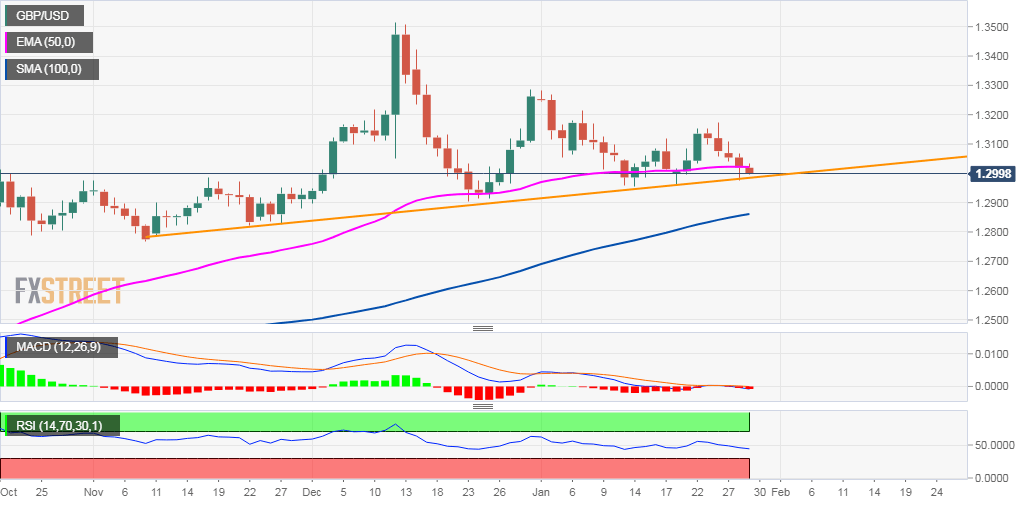

GBP/USD Price Analysis: Flirting with trend-line support, around 1.3000 mark

- GBP/USD remains depressed for the fifth consecutive session on Wednesday.

- The technical set-up might have already shifted in favour of bearish traders.

The GBP/USD pair edged lower through the early North-American session on Wednesday, with bulls now eyeing some follow-through weakness below the key 1.30 psychological mark.

The pair is now flirting with an important support marked by 2-1/2-month-old ascending trend-line, which if broken will set the stage for an extension of the recent bearish trajectory.

Meanwhile, technical indicators on hourly/daily charts maintained their bearish bias, which supports prospects for an eventual break below the mentioned trend-line and further weakness.

Some follow-through weakness below the overnight swing low, around the 1.2975 region, will reaffirm the bearish bias and accelerate the slide further towards the 1.2955-50 area.

The latter coincides with monthly swing lows and hence, some follow-through selling will set the stage for a slide towards challenging 100-day SMA support, or sub-1.2900 levels.

On the flip side, any attempted recovery might confront some fresh supply near the 1.3030-35 region, above which the pair could head towards the 1.3070-75 horizontal barrier.

Sustained strength beyond the mentioned hurdles might prompt some follow-through short-covering move and lift the pair further towards reclaiming the 1.3100 round-figure mark.

GBP/USD daily chart