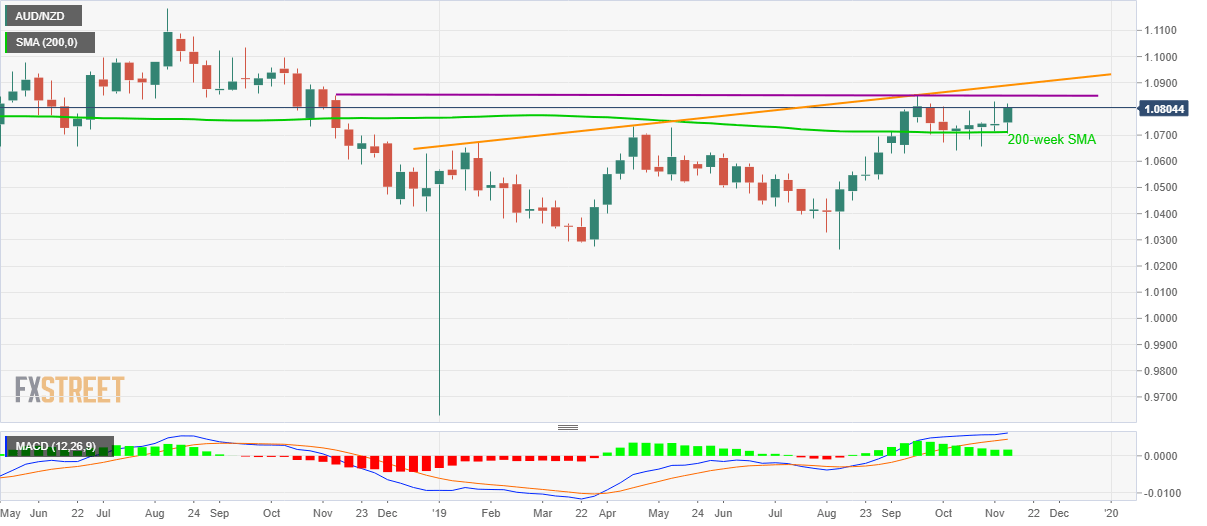

AUD/NZD technical analysis: Soft NZ employment data keep 1.0850/52 in focus

- AUD/NZD stays positive above 200-week SMA.

- Bulls will look towards inverse “head and shoulders” beyond the key resistance area.

With the quarterly data from New Zealand keeping AUD/NZD bulls pleased, the quote takes the bids to 1.0810 during Wednesday’s Asian session.

New Zealand’s (NZ) third quarter (q3) employment report sound overall downbeat with Unemployment Rate declining to 4.2% from 4.1% forecast and 3.9% prior whereas Employment Change was marked lower than 0.3% expected to 0.2%. On the contrary, Participation Rate rose beyond 70.3 mark to match 70.4 prior while the Labour Cost Index (QoQ) came in at expectations of 0.6% versus 0.8% prior.

As a result, the pair extends its U-turn from 200-week Simple Moving Average (SMA). However, 1.0850/52 area, comprising highs marked in late-September and also during early November 2018, stands tall to challenge the bulls.

In case prices rally beyond 1.0852 on a weekly closing basis, an inverse “head and shoulders” formation will need to be confirmed by a break above 1.0895 – 1.0900 to extend the run-up.

Meanwhile, the pair’s downside below 200-week SMA level of 1.0712 highlights October lows surrounding 1.0640 to sellers.

AUD/NZD weekly chart

Trend: bullish