Back

4 Apr 2019

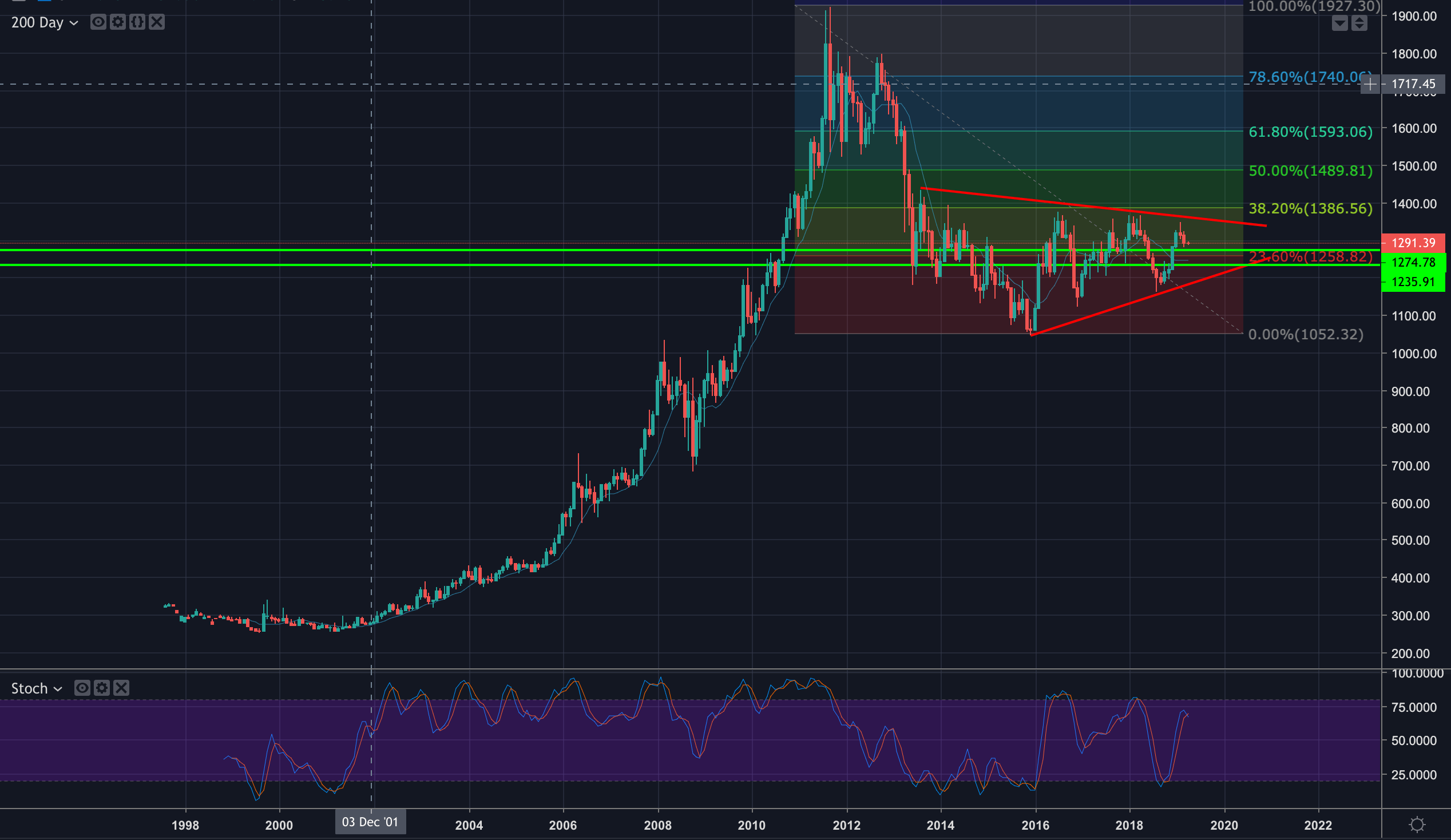

Gold Technical Analysis: 1307 and the 38.2% are key to the upside, 1275 is key to the downside

- Bulls remain below the 1300 level which was the being the 50% reversion target of the latest sell-off.

- The price has been consolidating since dropping out of the rising channel.

- The price has been testing the support of the 29th March lows and the rising support from Nov's bull trend.

- Daily stochastics are oversold and bulls look to the 1300's again if 1285 holds.

- However, failure through 1307 and the 38.2% Fibo confluence of Feb support and resistances, the downside will remain compelling, with a target set at 1275 (38.2% fibo retracement of the Aug 2018-Feb swing lows and highs) and below where the 200-DMA will come into play, (1250/50% Fibo area).