Gold Technical Analysis: Manages to hold above 200-hour EMA/trading range support

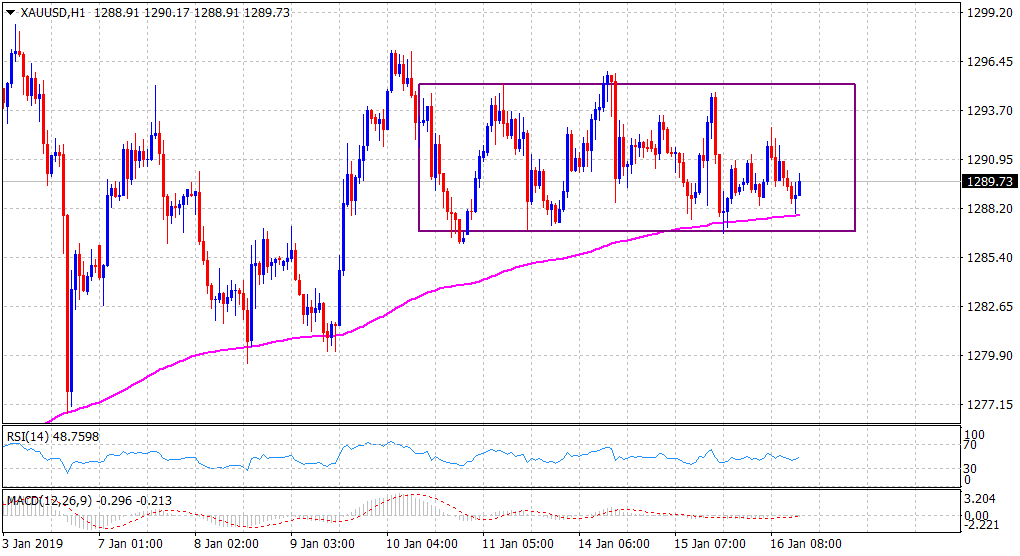

• The precious metal has been oscillating in a broader trading range over the past week or so, forming a rectangular chart pattern on short-term charts.

• The fact that bulls have repeatedly failed to make it through the key $1300 psychological mark points to a possible long-unwinding pressure in the near-term.

• Moreover, technical indicators on hourly charts have just started losing positive momentum and further add credence to expectations of some follow-through pull-back.

• However, the lower end of the trading range now coincides with 200-hour EMA and acting as immediate strong support since the US trading session on Tuesday.

Gold 1-hourly chart

• Hence, it would be prudent to wait for a sustained breakthrough the mentioned support before traders start positioning for any further near-term downtick.

• Alternatively, a sustained breakthrough the trading range resistance, leading to a subsequent strength beyond the said handle will negate any short-term negative outlook.

XAU/USD

Overview:

Today Last Price: 1289.7

Today Daily change: 64 pips

Today Daily change %: 0.0496%

Today Daily Open: 1289.06

Trends:

Previous Daily SMA20: 1278.53

Previous Daily SMA50: 1247.69

Previous Daily SMA100: 1230.43

Previous Daily SMA200: 1228.94

Levels:

Previous Daily High: 1294.75

Previous Daily Low: 1286.95

Previous Weekly High: 1297.15

Previous Weekly Low: 1279.35

Previous Monthly High: 1284.7

Previous Monthly Low: 1221.39

Previous Daily Fibonacci 38.2%: 1289.93

Previous Daily Fibonacci 61.8%: 1291.77

Previous Daily Pivot Point S1: 1285.76

Previous Daily Pivot Point S2: 1282.45

Previous Daily Pivot Point S3: 1277.96

Previous Daily Pivot Point R1: 1293.56

Previous Daily Pivot Point R2: 1298.05

Previous Daily Pivot Point R3: 1301.36