AUD/USD Review: accelerating into 0.7350

- The Aussie is drifting further heading into Friday's more liquid sessions.

- A stalwart RBA is hoping for further declines in the AUD to bolster Australian exports in a bid to generate growth in their domestic economy.

The AUD/USD is trading into 0.7350 as Friday sees markets pushing n favour of the Greenback as risk aversion remains just beneath the surface to cap off the trading week.

The Reserve Bank of Australia's (RBA) latest Statement of Monetary Policy delivered nothing of value for traders to digest, with the central bank well-entrenched in their current wait-and-see strategy after two straight years of no policy moves, and the AUD/USD sees Friday's upcoming US CPI reading as the final event of the week.

The US inflation reading, expected at 12:30 GMT, sees US Core CPI for the year to July forecast to hold steady at 2.3%. Inflation in the US has been on the high side by comparison to most other developed economies, spurring the US Fed to a faster pace of rate hikes than other central banks, leading to a widening rate differential, providing a healthy base of support for the USD, which was broadly expected to decline for 2018. A positive reading for US CPI numbers for Friday could see the Greenback take another leg up across the broader markets as traders scramble to adjust for a US Fed that is likely to remain hawkish and be quick on the jump to head off further inflation that threatens to become hazardous.

AUD/USD Technical Analysis

The Aussie faces further decliners as the broader market slowly rolls over into another spat of USD-buying with the RBA providing little support for the hammered AUD. The AUD/USD has been trapped in a rough range for over eight weeks, and sellers would be all too happy to break the lower bounds of consolidation and re-establish a longterm bear trend.

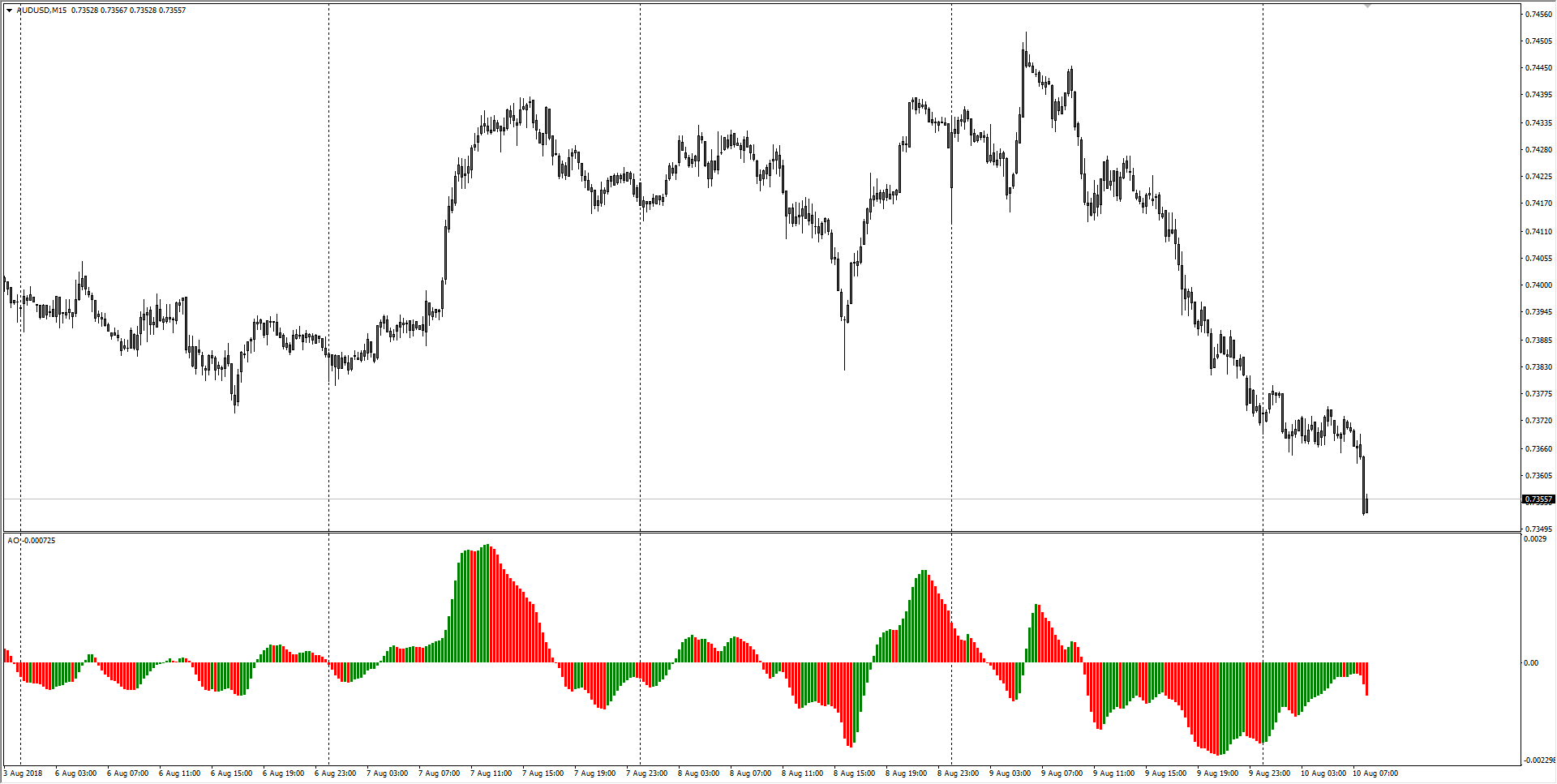

AUD/USD Chart, 15-Minute

| Spot rate: | 0.7355 |

| Relative change: | -0.24% |

| High: | 0.7379 |

| Low: | 0.7352 |

| Trend: | Bearish |

| Support 1: | 0.7352 (current week low) |

| Support 2: | 0.7347 (previous week low) |

| Support 3: | 0.7317 (four week low) |

| Resistance 1: | 0.7379 (current day high) |

| Resistance 2: | 0.7400 (major technical level) |

| Resistance 3: | 0.7452 (current week high) |