Back

17 Jul 2018

GBP futures: rallies appear tepid

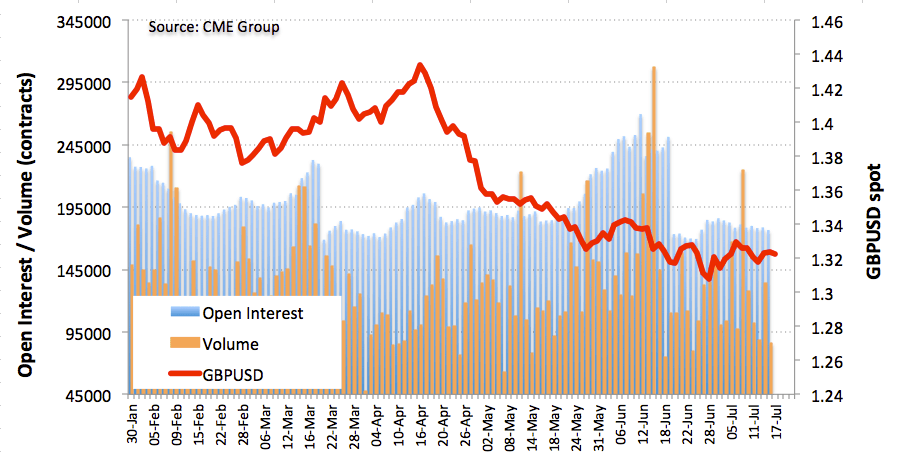

CME Group’s preliminary figures for GBP futures markets saw investors trimmed their open interest positions by 2.1K contracts on Monday from Friday’s final 178,871 contracts. In the same line, volume decreased markedly by more than 48.5K contracts.

GBP/USD another test of 1.3050 is not ruled out

Cable continues to trade in a sideline fashion in the lower bound of the trading range after the rejection from last week’s tops in the mid-1.3300s. Shrinking volume and open interest coupled with Monday’s doji-like candle leaves occasional bullish attempts unsustainable, while the attention should shift to the mid-1.3000s, or 2018 lows, seen in late June.