Back

15 Jun 2018

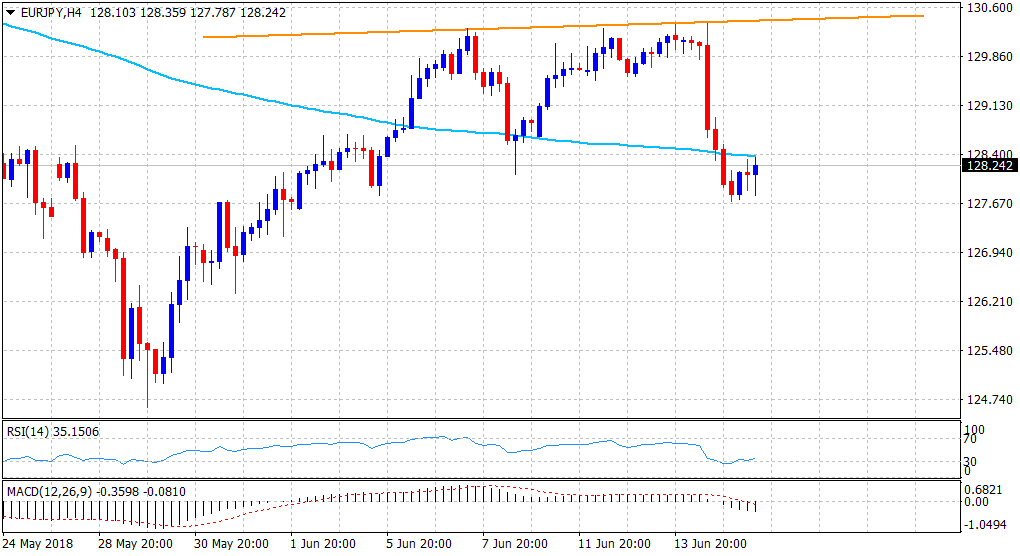

EUR/JPY Technical Analysis: post-ECB modest rebound pauses at 100-period SMA on H4

• A modest recovery attempt from the post-ECB swing low and short-term oversold conditions tests 100-period SMA on 4-hourly charts.

• Any meaningful recovery might now be capped at the 129.00 round figure mark.

• A subsequent slide back below the 127.70 area now seems to pave the way for an extension of the overnight rejection slide from 50-day SMA key barrier.

EUR/JPY 4-hourly chart

Spot Rate: 128.24

Daily High: 128.36

Daily Low: 127.70

Trend: Bearish

Resistance

R1: 128.68 (Monday's weekly opening level)

R2: 129.00 (round figure mark)

R3: 129.49 (200-period SMA H4)

Support

S1: 127.70 (daily low)

S2: 127.13 (monthly low set on June 1)

S3: 126.80 (horizontal level)