Back

24 May 2018

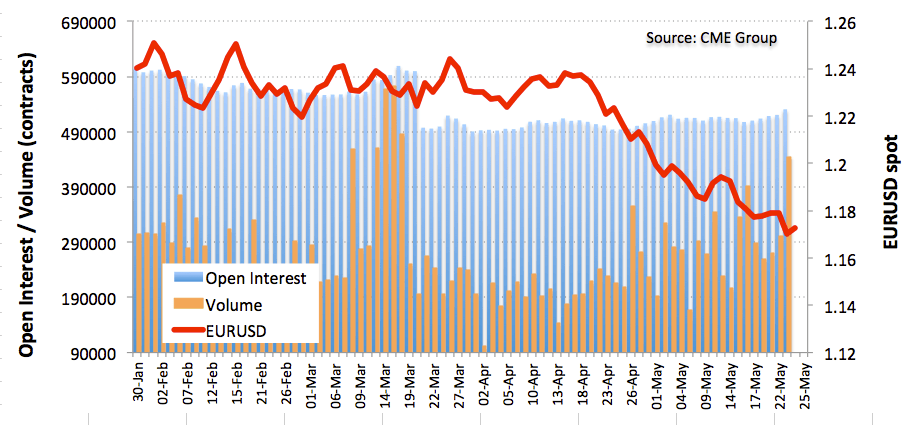

EUR futures: bearish mood entrenched

CME Group’s advanced figures for EUR futures markets showed investors added more than 10K contracts on Wednesday from Tuesday’s final 520,648 contracts. Open interest has been rising for the last five sessions so far and yesterday’s build was the largest since April 10. In the same line, volume rose to the highest level since March 16, up by almost 145K contracts, recording the third consecutive increase.

EUR/USD points to further decline

The move lower in EUR/USD appears to still have legs amidst increasing open interest and volume. The next significant level on the downside should be 1.1616, 2016 highs seen on May 3.